Happy New Year Everyone!

We are about to start the first trading day in 2025. I hope it will be a great year.

As much as I love writing about the current market, economic conditions and their impacts, I am not a huge fan of doing yearly outlooks.

Why?

There are a plethora of factors, indicators, and events that transpire throughout the year that getting it right is almost impossible. If one does get it right, an incredible amount of luck is involved. Take this post from Sven Henrich as an example of price targets from big banks for their end-of-year (EOY) 2024 predictions of the market.

The EOY for the S&P 500 in 2024 was 5,881.63. Here are the estimates below:

Even with their sophistication and large number of resources, their predictions were off.

Let’s see what a few of their predictions are for EOY 2025 from Brew Markets. They all made safe bets that the S&P500 will rise around 8-12% because that is the historical average.

I want to do something different this year as I think a more valuable approach to an outlook is to discuss a few crucial scenarios that are possible to happen throughout 2025. I will focus on unemployment, interest rates and inflation, and stock market prices. I’ll show how adjustments will be made to my portfolios given each situation.

Just as a note, these situations are looked at in isolation. Just because it happens doesn’t mean something will change but it, nonetheless, gives a high level view of what I might do given each event.

Unemployment

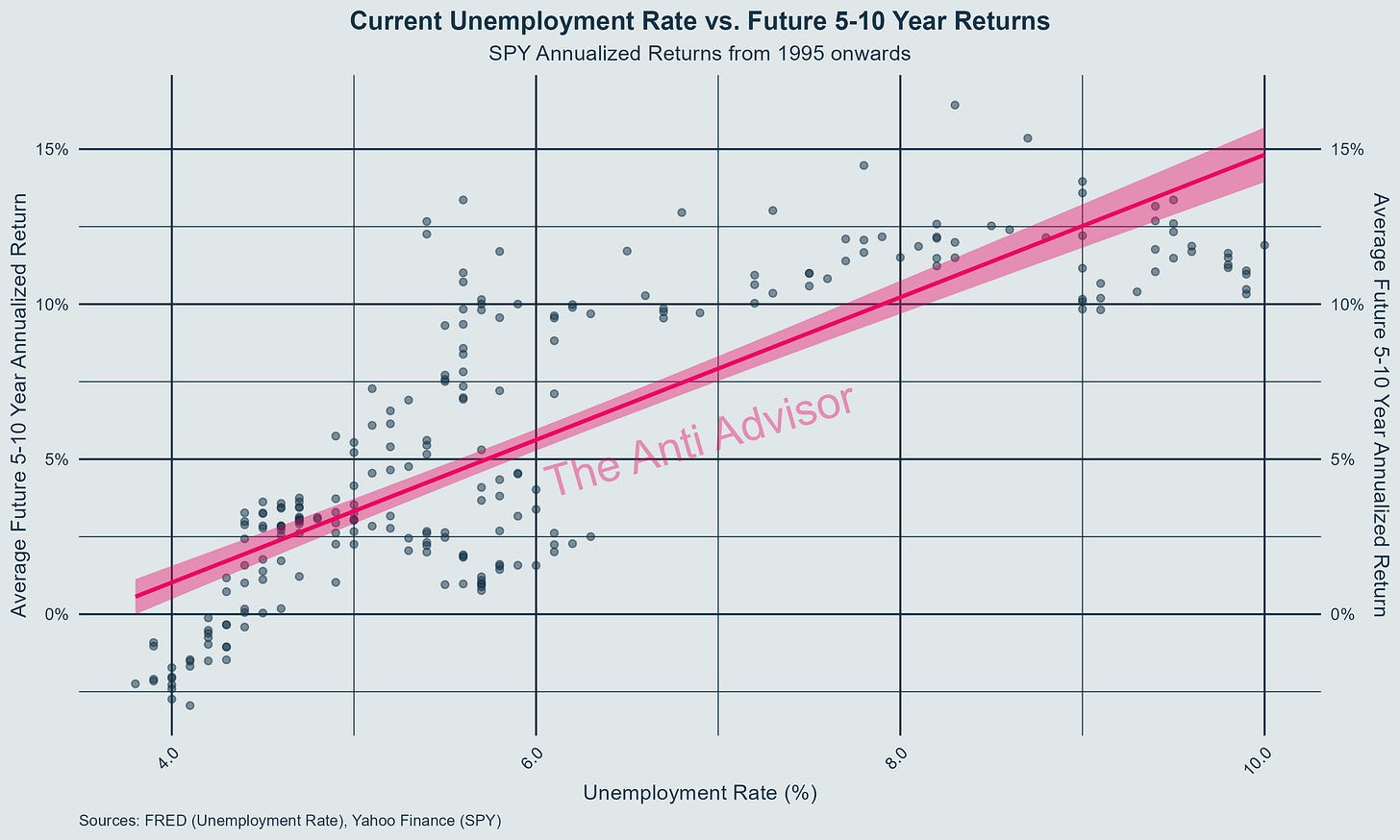

This is one of the many factors I use to justify the positioning of my portfolios. Unemployment can be used as an indicator of what future expected returns for the market could be. It is not perfect, but the research says that as unemployment rises to and past a certain level, future returns of the stock market tend to be higher. Below are two visual representations showing the relationship between current unemployment and the average of the future 5-10 year returns since 1995.

Here are likely situations:

If unemployment is flat or falls, it is highly unlikely I will change my positions.

If unemployment rises significantly, it is appropriate to overweight equities.

Interest Rates and Inflation

Interest rates are going to be tied to inflation in 2025. Inflation has been sticky for the better part of 2024 and it is not at the Fed’s target of 2%. They will be looking at inflation, in conjunction with unemployment, to determine a rate increase, decrease, or remain neutral.

While short-term rates are important, longer-term interest rates can have a much more substantial impact on the overall economy because of their links to mortgage rates and business loans.

These are the foreseeable conditions:

If interest rates stay the same or rise, it is unlikely I will change positions.

If interest rates fall, the appropriate measure would be to go neutral bonds.

Stock Market Prices

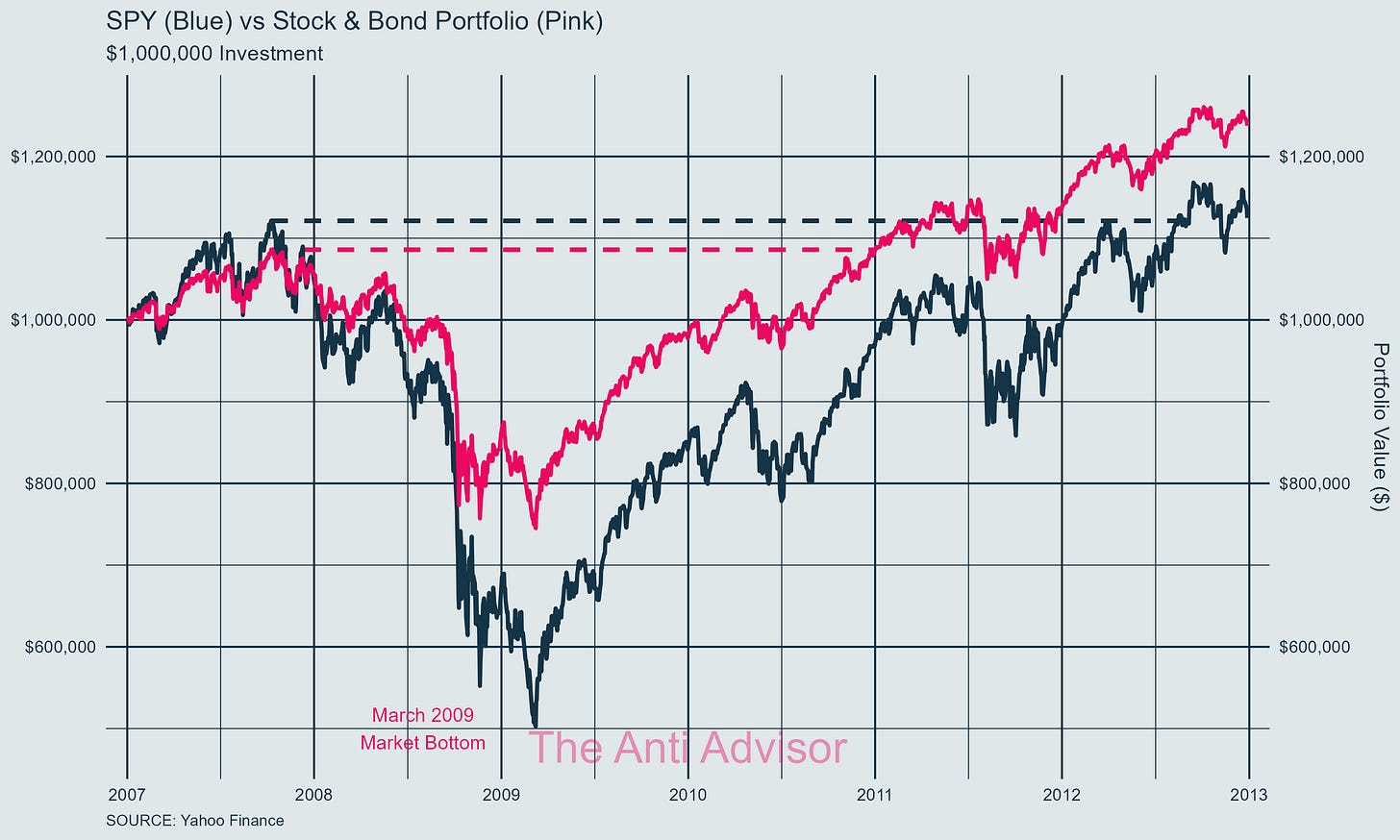

Stock market prices can be used to adjust equity positions using technical analysis. I can use a simple strategy of mean reversion or price drops in the market to change my allocation to equities. It sounds easy to do but can be difficult given the psychological aspects. When the market falls, let’s say 15%, a lot of investors are thinking about how much further it can go depending on the catalyst. Fear is high. Take the Great Financial Crisis as an example below with its over year long drawdown and multi-year recovery.

Consider these potential outcomes:

If stock prices remain flat or rise, it is unlikely I will change positions.

If prices fall substantially, the appropriate measure would be to add to equities.

Conclusion

All of this is subject to change of course. There are an infinite number of possibilities when it comes to market and economic events in 2025. Maybe there is a black swan event, such as the Great Financial Crisis or maybe nothing happens, and the market goes up a predictable 10%. What matters is having clear triggers - significant changes in unemployment, substantial interest rate moves, or major price drops - to guide portfolio adjustments. Like the big banks showed us with their 2024 predictions, getting exact market calls right involves too much luck. Instead, we'll stay focused on these and other indicators to adjust accordingly as data is released.