Sequence of returns risk refers to the potential impact that the order of investment returns can have on a portfolio, particularly during retirement or when making regular withdrawals. It's a crucial concept that many investors overlook, yet it can significantly affect their long-term financial outcomes.

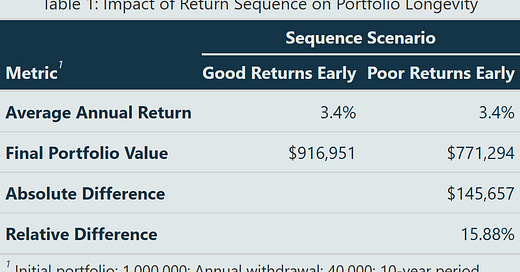

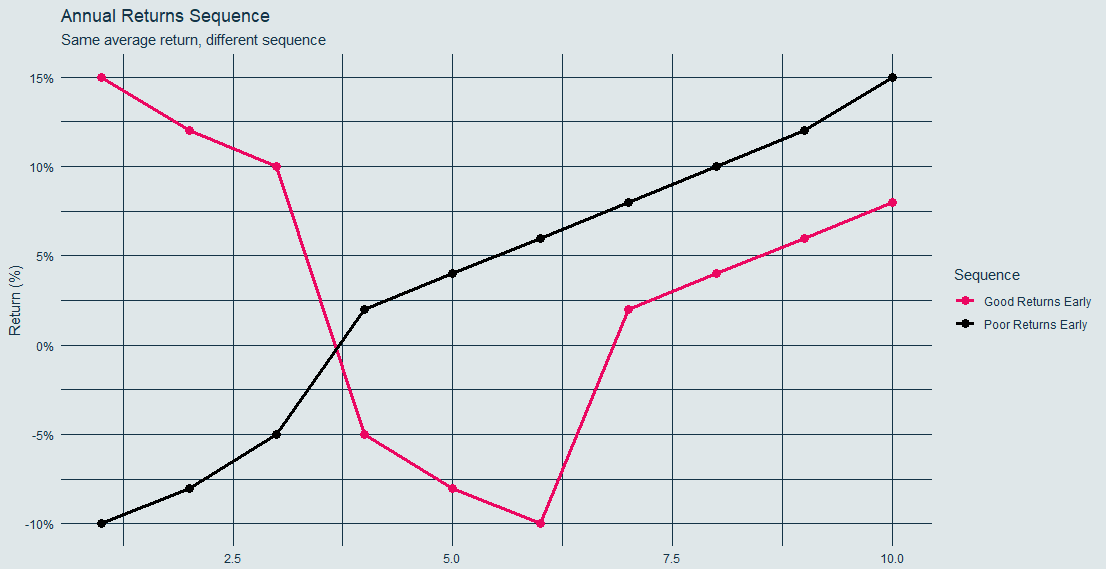

Consider two investors who experience the same average returns over a period but in different sequences. The investor who encounters poor returns early in retirement while making withdrawals may deplete their portfolio much faster than one who experiences those same poor returns later.

This is because withdrawing money during market downturns forces the sale of more shares to generate the same amount of income, leaving fewer shares to participate in eventual market recoveries.

This risk is particularly relevant for retirement planning, as it demonstrates why traditional metrics like average returns alone don't tell the complete story.

To manage sequence risk, investors often employ strategies such as maintaining a cash buffer, using a dynamic withdrawal strategy, or diversifying across uncorrelated assets. These approaches can help protect against the potentially devastating impact of experiencing significant market declines early in retirement.