The Standard & Poor’s (S&P) 500 is the most recognized index in the entire world and represents 500 stocks in the United States.

In investment and portfolio management, we call these stocks, Large Cap. Large Cap stocks are companies with a market capitalization typically above $10 billion. The S&P 500 tracks the performance of 500 of the largest publicly traded companies in the United States.

It has been considered a barometer for the overall U.S. stock market. The index is market-capitalization weighted, meaning larger companies have a greater impact on the index's performance than smaller ones. Companies like Tesla, Apple, Microsoft, and Amazon often have significant influence on the index's daily movements due to their massive market capitalization’s. The smaller ones, less so.

The significance of the S&P cannot be under or overstated, which is why it is the focus of this post. Here are 6 reasons why the S&P plays such an important role in our investment philosophy and My Portfolios:

Global Leadership Hub

Risk Management Tool

Portfolio Anchor

Market Sentiment Indicator

Efficient Return Modeling

Home Country Bias and Benefits

Note: You cannot directly invest in the S&P 500 index. Most people choose to purchase an S&P 500 ETF (exchange traded fund) to capture exposure.

1. Global Leadership Hub

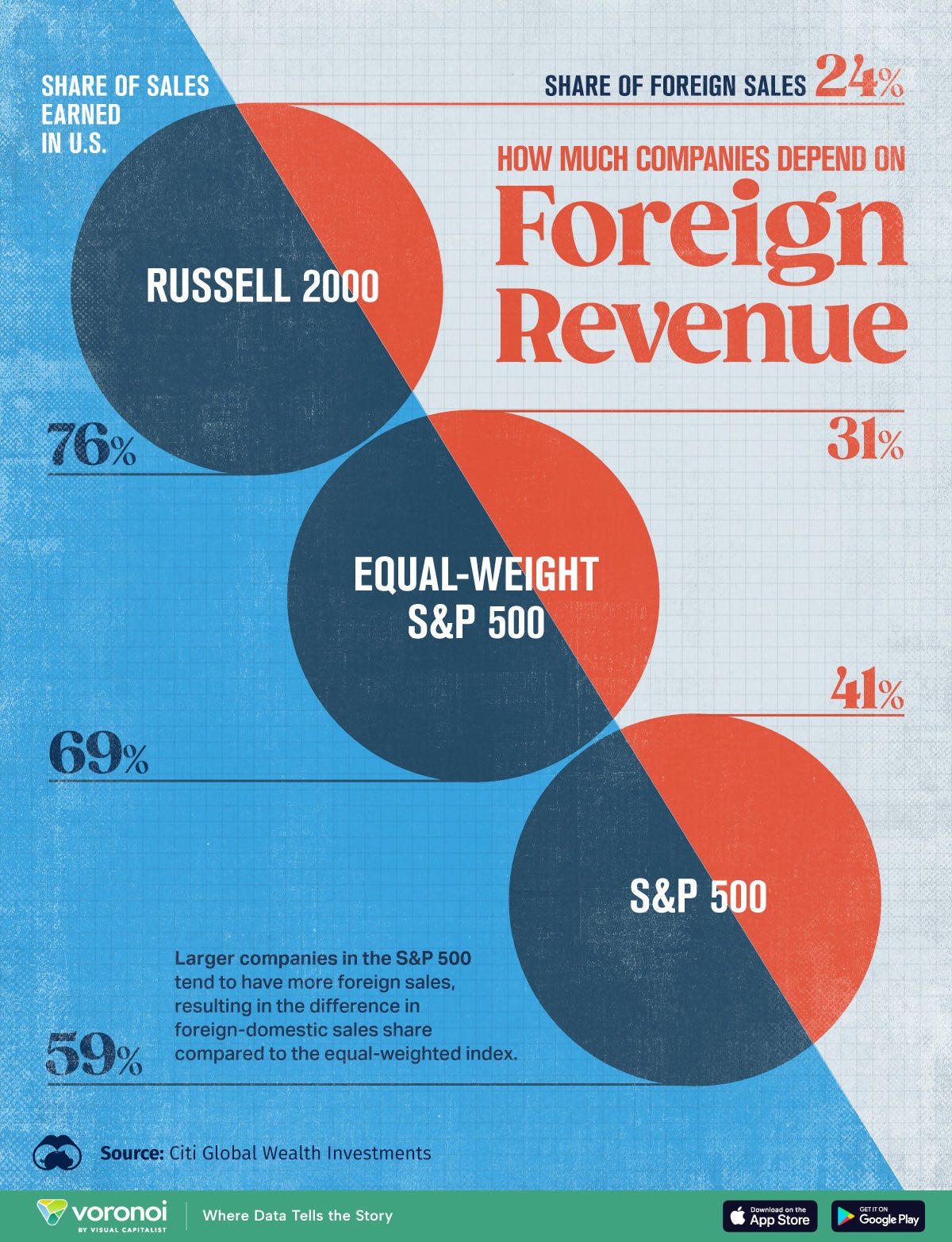

The S&P 500 houses world's most innovative companies such as Tesla, Amazon, Apple and increasingly NVIDIA. These companies reach almost every continent in the world and their value as leaders in innovation and technological advancement is something to be admired. That said, the S&P captures multinational revenue streams. 41% of the S&P’s revenue is from foreign sources. Because of this fact, we can see how the S&P can act as a proxy for global economic growth. If the S&P 500 is rising or falling, we can use it as an indication of how other parts of the world are doing economically.

2. Risk Management Tool

When we think of risk management, we think diversification. The S&P 500 has this! Breaking down the S&P 500 by industry shows how one can be exposed to multiple sectors through one index. There are many sectors of the S&P 500 including utilities, real estate, technology, healthcare, etc. Here are all of them.

Beyond diversification, there is the auto rebalancing of the S&P. If a company does not meet the requirements to be in the index, then the company will be replaced with another. All without you having to do anything. This also applies to the exchange traded funds that track the index. This makes it easier to stay invested and keep the diversification. No rebalancing is needed.

3. Portfolio Anchor

The S&P 500 can be used as a core position for long-term growth. The data goes back to 1957 and has a solid track record of returning 8-10% annually (depending what metric you use). It has long-term predictability that can calm investors’ minds when using it as a main position in a portfolio. Using S&P 500 ETF captures the gains of the most productive index in the world. With its proven track record and broad market exposure, the S&P makes it an ideal cornerstone for long-term investors.

4. Market Sentiment Indicator

The S&P 500 is seen as a indicator for the overall health of the U.S. economy. When the S&P 500 rises, it indicates that investors are optimistic about the future earnings of companies, economic growth, and overall market stability. Conversely, a decline suggests pessimism or fear among investors regarding economic downturns or geopolitical risks.

The index's movements can influence individual and institutional investor behavior, driving decisions like portfolio reallocation, whether to invest more or pull back, and expectations for future market performance.

5. Efficient Return Modeling

One of the best parts of the S&P 500 is the sheer amount of data. Everything from earnings, correlations, trends, relationships to economic indicators and more. We can extract the returns data from 1957 and analyze an economic factor against that to predict future returns. We have done just that and here are the results. There are many other factors that anyone could use to do this type of analysis. Of course, this does not tell the whole story, and many other factors need to be taken into consideration, but it is a start.

6. Home Country Bias & Benefits

Lastly, we do have a home country bias. It is easier to invest in an area you are familiar with than a market that is thousands of miles away.

However, there are a few added benefits to the approach. One is a natural hedge against US-based costs. Think of inflation. If inflation causes prices to rise (like gas, groceries, housing), the companies you are invested in are often raising their prices too. These companies then see higher revenues and profits, which lead to higher stock prices or dividends.

Second, is favorable tax treatment. US investors benefit from lower tax rates on long-term capital gains and qualified dividends from S&P 500 investments, typically paying 15-20% instead of higher ordinary income tax rates. If we were foreign investors, we may have to give up more on taxes but being locals, we get “special” treatment.

Conclusion

The S&P 500 stands as a cornerstone of investing, offering more than just market exposure. Its combination of global reach, automatic diversification, proven long-term returns, and tax advantages makes it an essential component of a well-structured investment portfolio. Whether serving as a market indicator, risk management tool, or portfolio anchor, the index's versatility and reliability continue to make it an invaluable asset for Our Portfolios.