Welcome to the first couple weeks of the new year.

Thanks to all the current and new subscribers. We have added over 50 new subscribers in the past month and a half and we are excited to continue to pursue our passion with everyone here. Let’s get into the market update without further ado.

A lot has happened in the past month since the December market update. The Santa Claus rally was confirmed to have materialized in early November after the election. December saw a small fall of 3% after the Fed meeting and another small drop toward the end of the month. In 2024, the S&P 500 soared along with Bitcoin surpassing $100k, only to fall below and it is currently hovering around 95K.

The beginning of this year we are seeing the S&P trading at levels before the election.

The 10-year treasury yield has been taking off surpassing 4.8%, pricing in future inflation and potential headwinds into 2025. If the 10-year at rises to 5%, mortgage rates have the potential to rise again to almost 8% as we saw at the end of 2023.

Housing prices are softening as average rates rise close to 7% for 30-year mortgages.

In just a couple of weeks Donald Trump will have his inauguration. He will begin with his government spending reform, and we will have more information on what he is going to do with tariffs.

The major concern is how concentrated the S&P 500 is with only the top seven companies providing a lot of the returns.

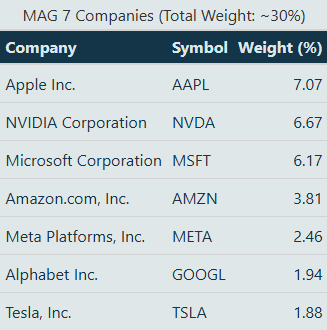

The Magnificent Seven (MAG 7), Apple, NVIDIA, Microsoft, Amazon, Meta, Google, and Tesla, has had such a huge impact on returns in 2024. I think it is worthwhile to drill down into it and see exactly what the composition is and how much risk is involved if something happens to tech. There are three points I would like to make.

Composition and Dominance in the S&P 500

Performance Divergence from the other 493

Risk Considerations

Composition and Dominance in the S&P 500

Composition and Dominance in the S&P 500

The composition of the MAG 7 is broken down below. It makes up roughly 30% of the overall S&P 500 at any given time. It does fluctuate as market caps change daily but this has been the overall picture and allocation to the S&P 500 for some time now.

These companies have achieved extraordinary growth since the 2007 financial crisis peak through today which is why they make up so much of the composition of the S&P 500. NVIDIA leads with a 185.0x return, followed by Tesla at 157.2x since its 2010 IPO. Amazon and Microsoft have delivered returns of 45.8x and 38.9x respectively. Meta has returned 28.3x since its 2012 IPO, while Apple has grown 23.8x. Alphabet (Google) has returned 13.1x over this period.

As you can see, the MAG 7 has had a heavy influence on the market.

Performance Divergence from the other 493

This is where things start to get interesting as we break out the returns from the MAG 7, the S&P500, and the other 493. Without the MAG7 the S&P 500 returns are quite small.