When we talk about tariffs, we are really discussing how governments use economic tools to achieve both political and economic objectives. The recent application of Trump tariffs offers insight into the practical uses and implications for markets, businesses, and consumers. I want to dive into 3 important topics for Tariffs:

Tariffs as Negotiating Tool

Reciprocal Tariffs on Other Countries

Economic Analysis

Let’s keep it simple and not waste too much time because I’m sure you have heard a lot already.

Tariffs as Negotiating Tool

Looking at Trump's approach to tariffs, we see a consistent pattern of using them as leverage in international negotiations. First and foremost, we saw the use of 25% tariff threats against Mexico and Canada in January and February of 2025. During his first term, Trump used tariffs to renegotiate NAFTA into the USMCA.

The 25% tariffs on Canada and Mexico did pressure these countries to assist with U.S. border security and drug trafficking issues. A 10% tariff on Canadian energy products was also imposed to cushion consumer fuel costs. This approach clearly aims to reshape North American trade dynamics.

The China Factor: A New Chapter in Trade Relations

The flat 10% tariff on all Chinese imports in February 2025 marks a new phase in U.S.-China trade relations, building on the Phase One trade deal from Trump's first term. Phase One saw China commit to buying an additional $200 billion in U.S. goods, addressing intellectual property and technology transfer.

This strategy addresses multiple issues simultaneously, including trade deficits, intellectual property protection, and fentanyl precursor chemicals.

Reciprocal Tariffs on Other Countries

Don’t get it wrong. Trump wants tariffs on other countries who don’t play ball. I think its fair.

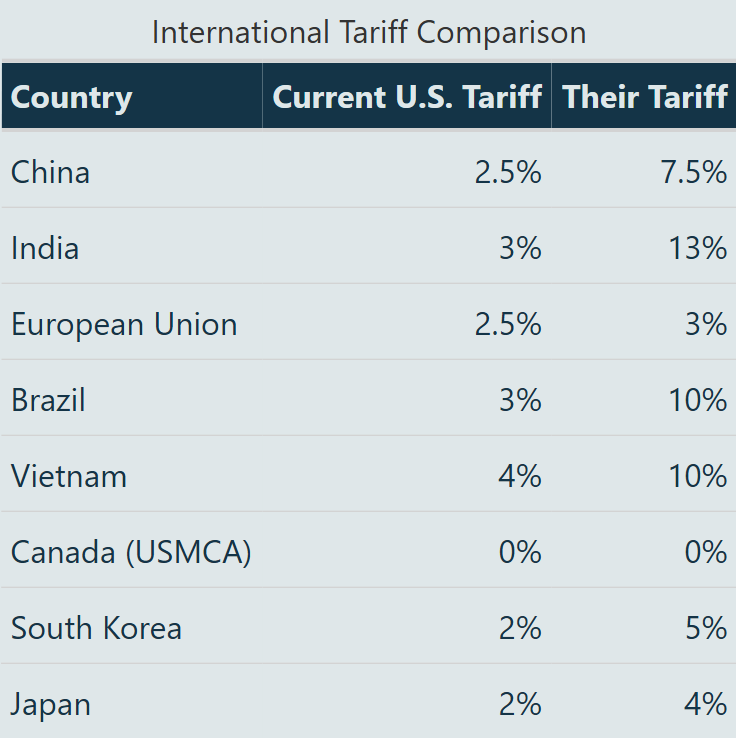

A critical examination of global trade practices reveals a persistent imbalance in how nations apply tariffs to U.S. goods compared to how the U.S. treats imports. Many of our trading partners maintain higher tariff rates on American products than what we impose on theirs.

For instance, while the U.S. might charge a 2.5% tariff on imported automobiles, some countries levy tariffs as high as 25% on American cars. This asymmetry extends across multiple sectors, from agricultural products to manufactured goods.

Note: This is an aggregate of all tariffs. Individual commodities may be higher or lower.

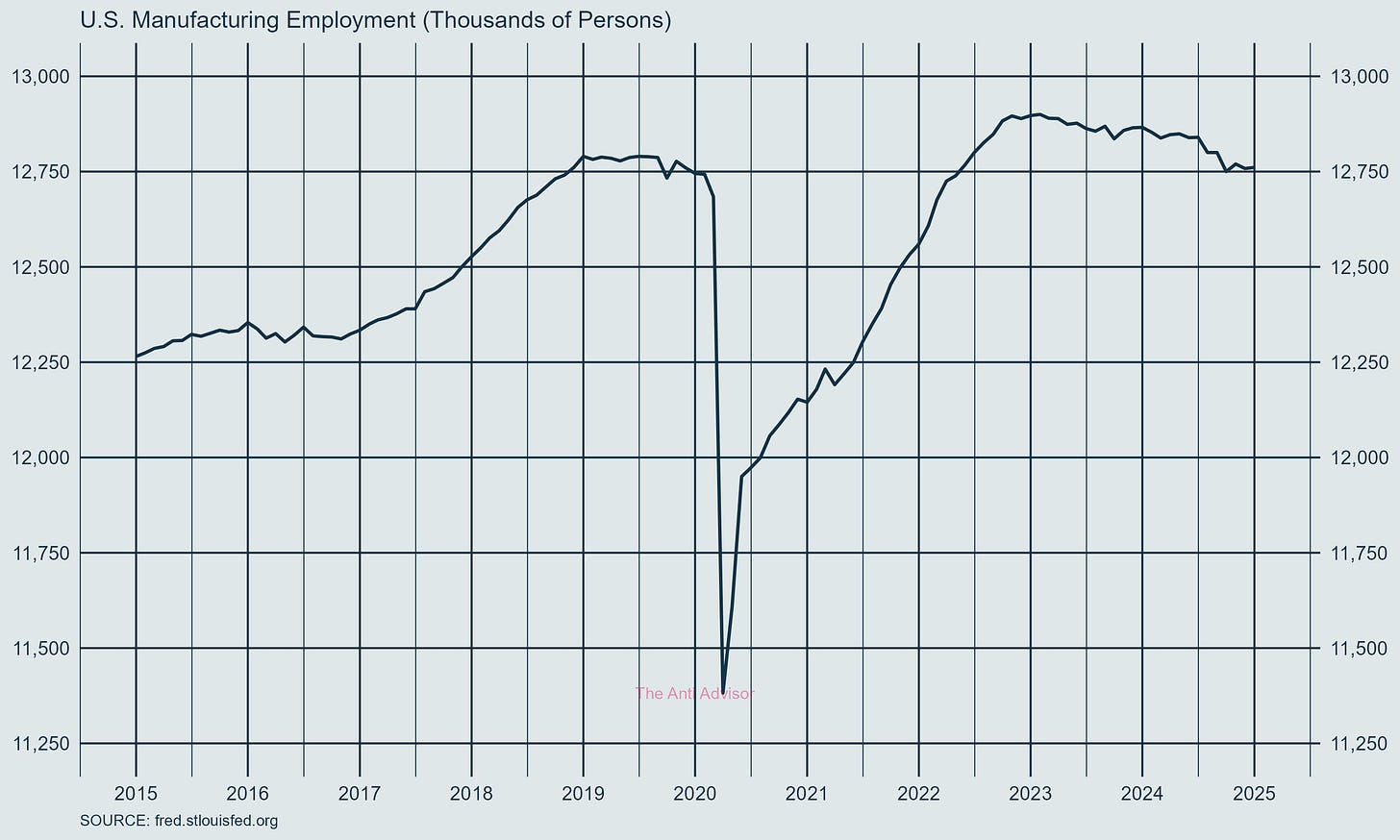

These uneven tariff structures create tangible disadvantages for U.S. manufacturers and exporters. American companies often find themselves competing in foreign markets where their products face substantial tariff barriers, while their international competitors enjoy relatively free access to U.S. markets. This imbalance affects not just market access but also investment decisions and job creation within the United States.

Economic Impact Analysis

The impact of tariffs on the economy isn't unlike the ripple effects we see in financial markets after a significant policy change. There are both direct and indirect effects to consider.

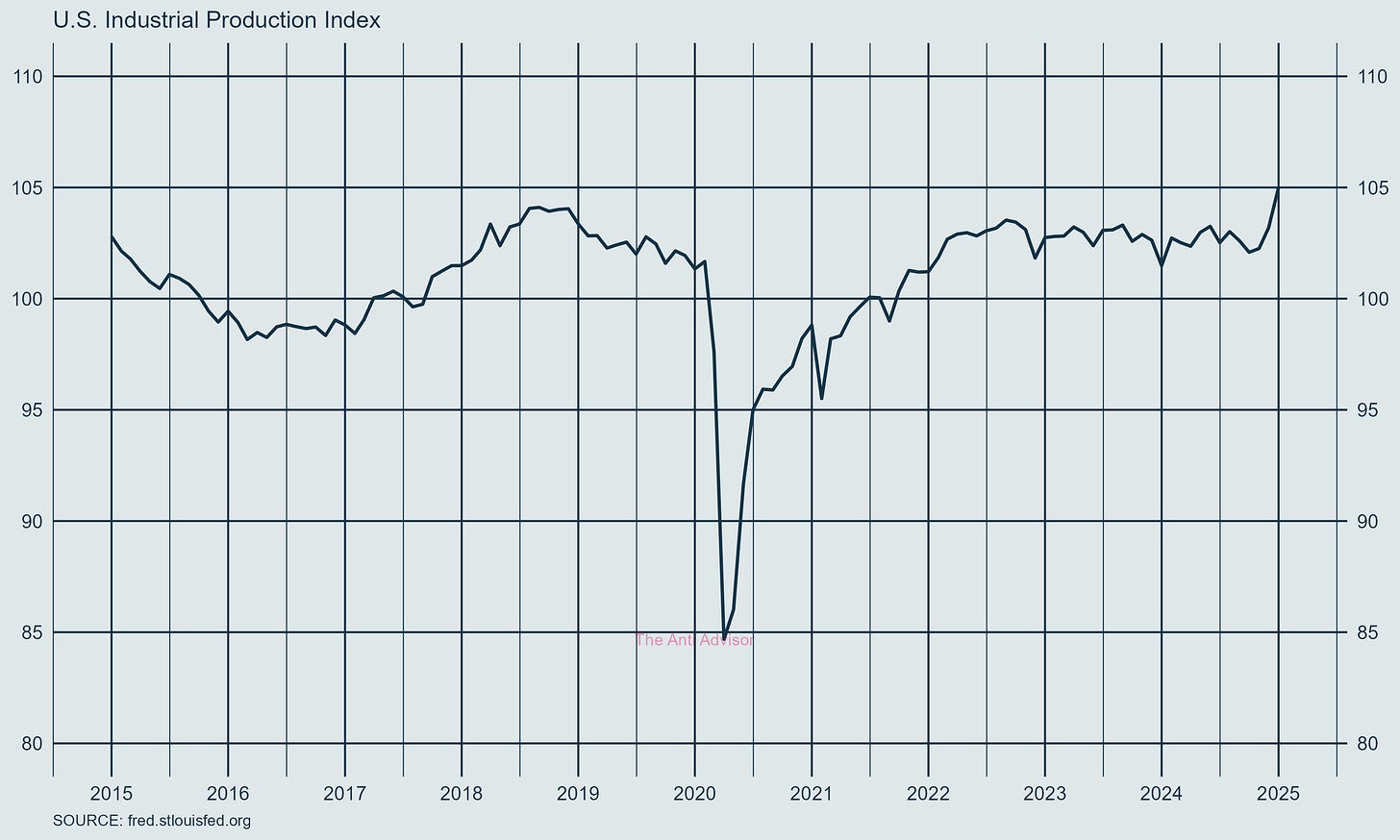

On the positive side, tariffs can serve as a protective mechanism for domestic industries, leading to job growth in protected sectors. They also generate federal revenue, which can be redirected to other policy initiatives or deficit reduction. Think of it as a form of economic insurance - you're paying a premium (higher prices) for protection against foreign competition.

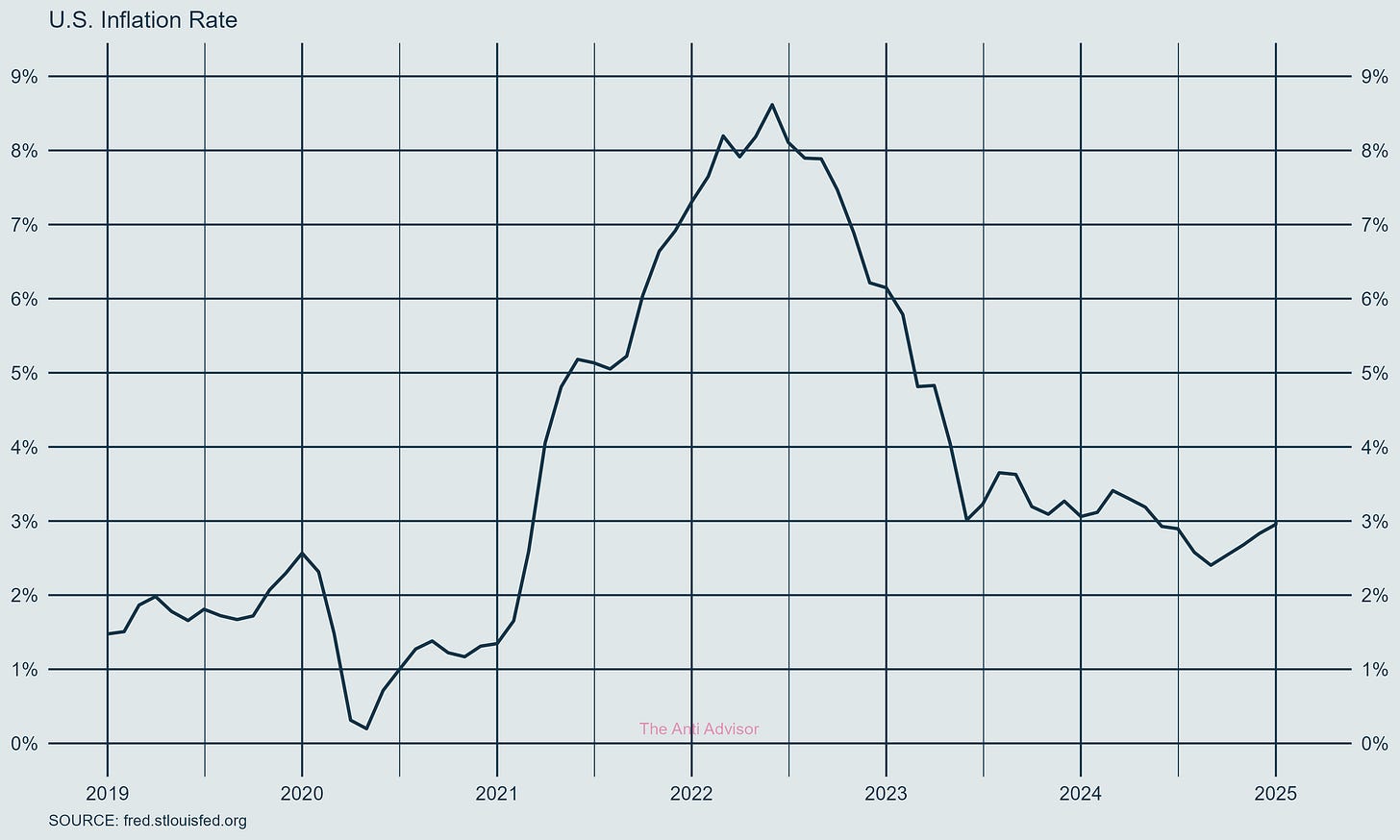

However, just as with any insurance policy, there are costs to consider. The most immediate impact is often seen in consumer prices, as importers pass along increased costs. Supply chains, particularly in industries like automotive where components cross borders multiple times, can face significant disruption.

Looking Forward: Markets and Policy Implications

As we move through 2025, understanding the interplay between tariffs and economic outcomes is crucial. Price differences between domestic and imported goods serve as indicators of tariff effectiveness, similar to how credit spreads signal market risk.

Tariffs present both opportunities and risks. The challenge for investors and businesses is to navigate this new trade environment while staying adaptable.

Remember, tariffs don't operate in isolation. Tariffs interact with monetary policy, fiscal decisions, and global economic conditions, much like bond yields must be analyzed within a broader economic context. Viewing tariffs as part of a larger economic strategy is required for a comprehensive understanding.

Good job on the analysis.